August 21, 2023

Financial Planning in Your 30s: 3 Goal Ideas for 30-Somethings

30 can be a divisive number. Some see it as the time you’re thrown into full-blown adulthood, whether you’re ready or not. Others consider 30 the early years before your true confidence shines; in your career, relationships, or even in yourself. Either way, your thirties are a great age filled with opportunity.

September 25, 2023

What to Do With a Sudden Windfall

While winning the lottery is well outside mainstream reality for most people, it’s not uncommon to suddenly receive a large inheritance, a settlement, or perhaps a stroke of good luck. There are several stories of the major failings of people who’ve come into money only to see it disappear.

August 2, 2024

Stock Options and Equity Compensation

Stock options can be a valuable asset in an individual's investment portfolio, but they are also complex financial instruments that require careful consideration.

September 4, 2023

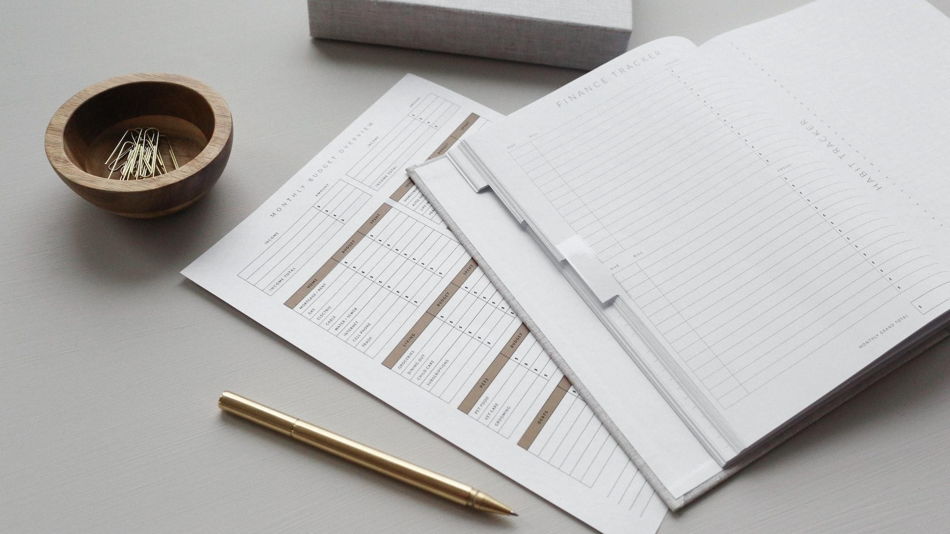

Financial Planning Basics: Creating and Maintaining a Budget

Whether you’re earning a six-figure salary or just out of college, many people feel budgeting is essential. Especially with the current economic climate, having a budget that you stick to may help keep spending under control, improve your savings, help you plan for retirement or other future goals, and keep debt manageable.

January 22, 2024

Self Employed Workers -- Family and Medical Leave Insurance

The state of Colorado has recently taken a significant leap forward in promoting family-friendly policies.

October 2, 2023

Navigating Fiscal Dramas and Market Downturns: What You Need to Know

The world of finance is never static. It's an ever-changing landscape that reflects the ebb and flow of economic indicators, political events, and public sentiment. Lately, the chatter about market downturns and fiscal squabbles in Washington has reached a fever pitch. So, let's break it all down for better understanding.

March 13, 2025

Roth Conversions--When it Makes Sense

Roth conversions have become an increasingly popular strategy for many individuals seeking to optimize their retirement savings.

July 30, 2024

Hiring Your Child and Contributing to their Roth IRA

Hiring your child and funding their Roth IRA

September 11, 2023

IRS Changes Inheritance Rules: Protecting Your Legacy

The IRS recently updated some rules about trusts that could make your heirs accidentally liable for capital gains taxes. It's another quiet change that could severely impact families trying to maximize their legacies.

September 18, 2023

Asset Allocation and Risk Allocation

With current market instability, inflation, and rising interest rates, more people are becoming acutely aware of the risks of investing. Financial markets are commonly known for their up-and-down nature, also known as market risk.

August 2, 2024

3 Reasons Why You Should Hire a Fee-Only Financial Planner

Are you looking for a financial planner who can provide unbiased advice and help you meet your financial goals? Hiring a fee-only financial planner might be the solution you're looking for.